Aging Successfully—Will Your Support Network Look Out for Your Interests?

On television, childless older adults can be portrayed as carefree people, living without demands from dependents. In reality, having no children—or having relatives who aren’t available or reliable enough to handle your affairs—can leave you and your estate vulnerable if you become incapacitated. For this reason, one of your most crucial activities in life will be legally binding, airtight arrangements to let someone you trust make health and estate decisions for you.

Family First? Most people would prefer their late-life and after-death affairs be taken care of by family members, and that can be an excellent choice. However, it’s important to select the most trusted—and business savvy—individual or entity available. That may not be your closest family member, and it may not even be a relative.

Choosing an extended family member or trusted friend to make decisions and manage your estate is another good option, provided you work with elder law professionals who can craft documents to survive a court challenge. If paperwork is not executed with care, other family members may successfully petition to overturn your decisions.

Additionally, if there are specific individuals in your family whom you do not want making your decisions, it is important to outline that in your directives and estate plans, as well. No one will know until the documents come into play that you made those choices.

Trusted Professionals? If you are especially close with a personal physician, they can serve as your proxy for healthcare decisions, but they cannot continue acting as your medical provider. The reverse is true for lawyers and other trusted business associates. Provided they accept the responsibility, attorneys, financial planners, and other associates can act as your estate administrator and manager, and some may be able to act as your healthcare proxy.

If you make this call, ask yourself if the individual could potentially profit from estate investments and other financial considerations. In such cases, you must have 100% unassailable faith and trust in the individual—or specify oversight from an unbiased third-party.

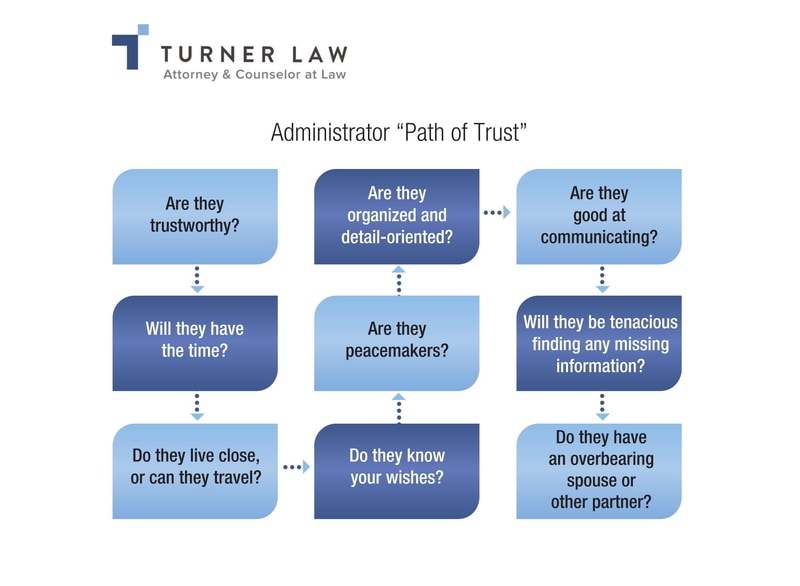

-

- Are they trustworthy?

- Will they have the time?

- Do they live close, or can they travel?

- Do they know your wishes?

- Are they peacemakers?

- Are they organized and detail-oriented?

- Are they good at communicating?

- Will they be tenacious finding any misssing information?

- Do they have an overbearing spouse or other partner?

Institutional Assistance

In the case of large estates (usually $1MM or greater), the most financially prudent decision may be ceding control to a large institution that offers estate management. There, a team of individuals will provide assistance and ensure rapid issue resolution. If your financial planner already works for such a firm, that company could provide a perfect mix of personal attention and institutional oversight. Note that working with an institution may require you to make them a trustee of your estate.

The Final Call

Choosing advanced healthcare and estate support isn’t a simple process, and choosing the same person for both requires even more consideration. Often, the most nurturing person to make healthcare decisions won’t have the business sense to be proficient at managing legal and financial matters.

No matter the outcome, you still must clearly enshrine your wishes in legal documents before you can no longer make decisions. To help you begin the process, review our “Estate Administrator Path of Trust” chart—factors to consider before making a decision.

Posted on the behalf of Turner Law, LLC